The physical version of PAN card for NRI, OCI or Foreign Citizen maybe vital for financial matters in India.

Individuals transferring or selling Indian property and taking advantage of banking interest rates require correct documentation and formats.

Also, in terms of assets, the Indian government has tax treaties with many countries to avoid double taxation and ensure fair taxation for different types of income. These treaties protect taxpayers in accordance with provisions.

Taking advantage of these treaties can help in tax planning for your assets in India. And, the Indian PAN is an important regulatory requirement within this framework in India.

Key Points

- This article aims to provide an overview of the “physical PAN Card” known as a “hard copy” versus a soft copy.

- It also lists the key differences between both versions as well as understanding its relevance in terms of Indian property and banking.

To start with we consider any relative or recent updates relating to PAN.

Regulatory Updates & PAN Card

In terms of property sale, recent updates regarding (PAN’s) role in regulatory framework, ties into the introduction of (TAN) by the Indian government.

It is important to understand that TAN is a “Tax Identification Number” and it is different from (PAN) although associated to some degree. (TAN) is necessary when a Person of Indian Origin or OCI is selling property in India.

The TAN is issued on application for tax deducted at source (TDS) which the buyer of the property is liable to initiate during a property sale payment.

Usually, the representative overseeing the legalities of the sale process initiates this and PAN is needed at certain stages.

Due to different requirements across regions, holding a physical copy of the PAN card can be vital even if you hold an officially allotted electronic version.

This ties in with avoiding time sensitive delays where possible by holding both formats of PAN.

1. Avoiding Complications In Indian Property Sale

Depending on the application process, it can take between 10-15 days to obtain a physical permanent account number card. The process of obtaining a physical card is different to obtaining an E-PAN copy.

Further, the application time and delivery of the actual card should be factored in.

Therefore time sensitivity due to a lack of correct documents and their format can influence sales initiatives.

This underscores the significance of having a physical card, as failure to hold a physical card can add delays to financial dealings.

2. Legal Obligations of Sale & Requirement: Role Of PAN Card

Obtaining a PAN is vital for NRIs and PIOs to ensure compliance with tax regulations and facilitate seamless property sales and banking transactions in India.

It is essential to stay updated on any recent changes or updates related to PAN requirements and ensure that all necessary documentation is in place. Seeking the advice of a professional can help identify any issues in paperwork.

Despite the options presented between hard copy or an E-PAN, due to the difference in administrative processes, maintaining a physical card as well as an electronic version can serve better in the long run.

Furthermore, an individual should ensure that their personal details are up to date and if not proceed to do so.

Correct & Upto Date Details

For example, your name should be correct; ie, if an individual is based in the United Kingdom and wants to change their name on PAN, they may require a copy of “Deed Poll” to do so and follow the name change process.

Such instances may occur for example if an individual is divorced/remarried etc.

This can be helpful as additional documentation for future property sale, where an individual owns property in India and has changed their name.

3. Physical Card & Why It’s Important

The physical card can be helpful for NRIs, PIO or OCI regarding property sale paperwork and Indian banking requirements.

In some cases, an official entity may request a copy of a physical card. The entity may require a live copy of a physical card for regulatory requirements associated with sales or banking.

Furthermore, Indian banking regulatory practices are under continuous changes as rolled out by the Reserve Bank of India.

Depending on the entity, requirements may vary. For example this can be the case when opening demat accounts for Indian stock trading.

An individual would then need to apply for a physical card which would add between 10-20 days to the process.

4. Differences Between Physical Card & Electronic Version

Based on the law and subsequent regulatory requirements, maintaining the permanent account number has now become extremely important for financial dealings in India. This includes, Indian property and banking assets.

Below is an overview of the distinctions between a physical (hard copy) and electronic (soft copy) PAN card.

a) Hard Copy: Physical Card

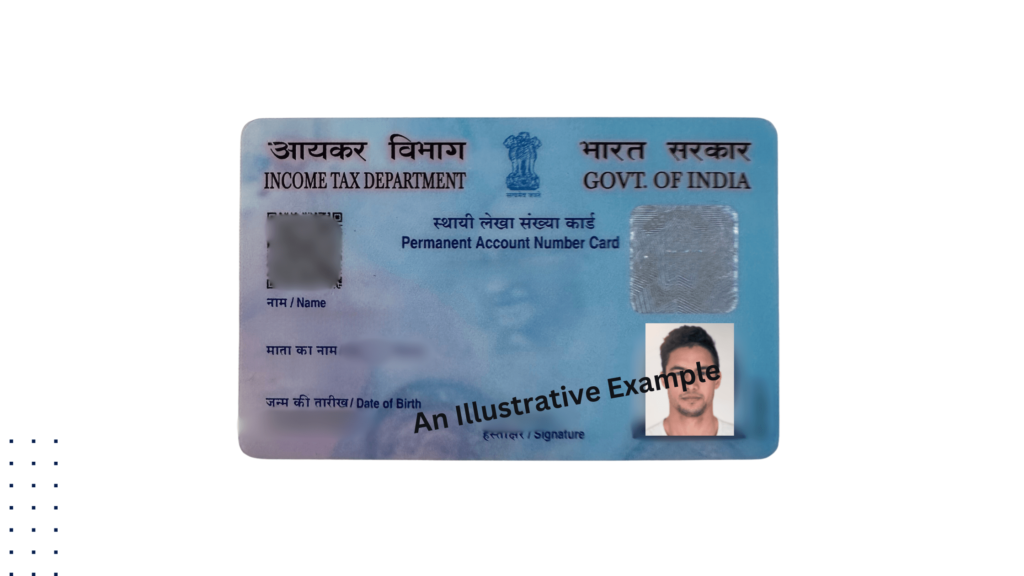

- The physical PAN card is a laminated, wallet-sized document issued by the Income Tax Department of India. It is a tangible card that contains the individual’s photograph, signature, and PAN details.

- The physical card is dispatched through postal mail. It is a physical document that may require face-to-face verification and various financial transactions.

- The physical PAN card contains the individual’s photograph, which is a visual identification when presented for official purposes.

- In case of loss, damage, or any change in details, the physical card may require re-issuance. A new physical card is dispatched.

- The physical PAN card may take longer time for delivery due to postal mail. An applicant needs to wait for its physical possession.

b) Soft Copy: E-PAN (Electronic)

- A soft copy PAN, or e-PAN, is an electronic version of the PAN card. Issued in PDF format by the Income Tax Department of India.

- It contains the same information as a hard copy PAN, including the individual’s name, photograph, signature, and PAN number.

- A soft copy can be downloaded and saved on electronic devices such as smartphones, computers, or tablets.

- It can be used for online transactions, e-filing of income tax returns, and verification of identity.

- Once the PAN application is processed and approved, the e-PAN card is instantly available for download.

Both types of PAN serve the same purpose and are issued by the Income Tax Department of India on application. However, the main difference lies in the physical format of the document and its portability.

Lastly, it’s important to factor in differences in requirements, for instance at present OCI is not a mandatory requirement to open an NRO account but some banks may request otherwise.

PAN on the other hand is almost mandatory in most cases.

Summarising The Physical PAN Card

In summary, obtaining a physical version of the PAN card can be vital for non-resident Indians (NRIs), Overseas Citizens of India (OCI), and foreign citizens involved in financial matters in India.

It is important for property transactions, banking requirements, and tax planning due to the regulatory framework and for other Indian financial purposes.

Understanding the differences between the physical and electronic versions of the PAN card and ensuring accurate personal details are also essential for time sensitive financial dealings in India.

Related Services

A Power of Attorney may be helpful for property sale in India, we may be able to help.