There is considerable lack of clarity about whether or not there is a difference between a Foreign Citizen and Indian Citizen PAN Card. Further, there is a vast amount of information online attempting to answer this question. However, it is still unclear. In this segment we provide answers in accordance with the official authorities/regulations of India. The Income Tax Department Government of India, FEMA and the designated depositaries.

Before we move ahead, if you haven’t already read our previous segment on Documents required for Foreign Citizen application, you may wish to know more about it. Where you require some assistance in applying for your Foreign Citizen PAN from abroad, you may find PAN Card E-Guide Service beneficial.

Firstly, let’s take a look at the official authority behind the PAN. Subsequently, what guidelines have been set by them. What differentiates between Foreign & Indian Citizen PAN Cards.

Official authority;

Government of India – Income Tax Department – Depositaries

The Indian Government through its Income Tax Department, regulates and administers parts of the Indian financial system with the mandatory requirement of PAN. PAN is an abbreviation of Permanent Account Number. Originally it began in 1972 and then subsequently further adapted in 1995.

PAN plays an important part in the administration of the Indian financial system. If you carry out transactions in India, including repatriation it is likely you will require a PAN.

The use of PAN applies to both the individual as well as corporate entities and businesses. In the same way, it is a mandatory requirement in certain financial institutions and activities in India even for individuals. If you do not have your PAN, you should consider obtaining one.

Below are a few key points about the PAN Card

| PAN CARD – KEY POINTS | ||

| PAN is a mandatory financial requirement | PAN is not automatically issued | Your PAN should be up to date |

| It does not have an expiry date | There are two different application forms | PAN is issued by the Income Tax Department Government of India on application |

| PAN is issued in two different formats | PAN can be applied from abroad for a Foreign Citizen | It can take anywhere between 30-40 days for the whole application process from abroad |

| An individual would need to take initiative to update any information on their PAN | PAN & Aadhar is mandatory to link via UIDAI aside exemptions | Foreign Citizen PAN refers to anyone of Indian Origin who holds a Foreign passport |

| PAN is required for any Indian Bank Account | E-PAN is an electronic format issued on a primary email address | A Foreign Citizen will use Form 49AA |

In the second part of this segment, let’s look at the differences between a Foreign Citizen PAN and an Indian Citizen PAN.

In essence, the PAN itself is not different for an Indian Citizen or a Foreign Citizen. The format of the Card whether that is an E-PAN or a Physical PAN are the same.

The difference is in the process and requirements for the application. If not done correctly, it has implications to the use of your PAN thereafter.

To be more specific, the distinguishing factor between the two nationalities lies in the process of application. This is a critical point. As a result of incorrect initial process a number of individuals make mistakes on how to proceed.

Now we will explore in detail the Key factors of differentiation between Foreign Citizen PAN Card and an Indian Citizen PAN Card process.

1. PAN Card Application Form

The correct application form is the starting point.

The Income Tax Department Government of India states, to apply for a PAN Card;

- A Foreign Citizen must apply using – FORM 49AA

- An Indian Citizen must apply using – FORM 49A

If you select the wrong Form at the start of your PAN process you will not be able to fulfill the obligatory requirements. Your PAN application will be rejected.

Use of the correct Form highlights to the Indian authorities that you are a specific category individual. Therefore, there will be relative rules, guidelines, requirements and even beneficial exemptions associated with the category of your PAN Card. It is critical to ensure you use the correct application Form.

In the second place, the next differentiating factor; the difference in supporting documents during application.

2. PAN Card Supporting documents

As we’re predominantly centered on Foreign Citizens, we will pay particular focus to Form 49AA requirements from here on.

In like manner, supporting documents are a part of the mandatory application requirements for both Foreign Citizens and Indian Citizens when applying for PAN.

For a Foreign Citizen, Form 49AA requires that you provide two documents from the acceptable list of documents section.

Whereas for an Indian Citizen the requirements also include Proof of Identity document. This is not the case for a Foreign Citizen applying on an Individual basis.

| Foreign Citizen (Non Indian passport) | Indian Citizen (Indian Passport) |

| Number of documents to be submitted : 2 | Number of documents to be submitted : 3 |

Moreover, based on the application information you provide and subsequent evidential supporting documents, your PAN will be allotted by the Income Tax Department Government of India. On condition that, your application is in order of the requirements. In addition, you must ensure that you provide these in the correct format.

Thirdly, your AO Code is different to an Indian Citizens AO Code.

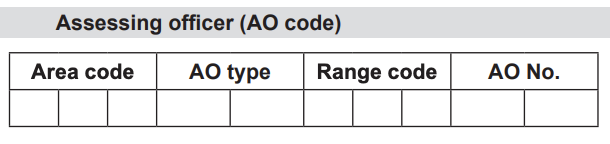

3. PAN Card AO Code

In particular, you as a Foreign Citizen, do not have to provide a specific AO Code if you are unsure of it. This may be due to your residence being predominantly abroad. In which case the advised AO Code would be selected, as per the guidelines of the Government of India. You can read more on your AO Code for Foreign Citizen.

In fourth place and our final differentiation point, is the limited options of application processing for a Foreign Citizen. Predominantly due to legal formalities when applying from abroad.

4. Limited Options – Comparatively

While it is true that applying for PAN as a Foreign Citizen previously was not as accessible. I.e. you had to apply in person in India yourself. On the other hand, in the recent decade, you can apply for a Foreign Citizen PAN without having to be in India. As a result of this, Foreign Citizens of India have been applying for PAN from abroad.

However, there are some limitations to the options that you have in applying for your PAN compared to an Indian Citizen. Below outlined are some of the comparatives;

| Foreign Citizen PAN Application | Indian Citizen PAN Application |

A) Supporting Documents or Documents to be submitted, must be sent to the depositary along with your application in hard copy format. B) No E-signature option | A) Supporting Documents or Documents to be submitted, can be completed electronically. B) E-signature option available |

In summary, to answer the question, “what is the difference between a Foreign Citizen PAN Card and an Indian Citizen PAN Card?” The key differentiation is the process of application. This sets the basis for you obtaining the correct Permanent Account Number. Further, it associates you under the correct guidelines for a Foreign Citizen under the umbrella of the Government of India.

The key takeaway is to ensure that you apply for PAN as a Foreign Citizen, correctly. Avoid timely & costly process due to mistakes.

How can we help you

If you need assistance, are unsure on parts of the application, avoid application delays or rejection. We can assist you with our Full Assistance New PAN Application Service

Frequently Asked Questions

From 1st April, 2010, non-furnishing of PAN to deductors results in TDS at much higher rate of 20% or even more.

It is not mandatory to file return of income after getting PAN. You would do so if section 139 applies to you.

Opening of bank accounts, in bank account, deposit of cash in bank account, opening of Demat account, transaction of immovable properties, dealing in securities, etc. A PAN card is a valuable means of photo identification accepted by all Government and non-Government institutions in the country

Related Services

- Transfer of property in India

- Indian Property disputes

- Sell property in India

- Power of Attorney Service

We can also assist with other Overseas Indian Services in London:

- Illegal occupation of property in India

- Family Settlements and partition of NRI Indian property

- Ancestral real estate and inheritance advisory under Indian law

- NRI Property Transfer

- Possession of NRI Property

- Recovery of NRI money under Indian Law

- NRI Succession Certificate in India

- Injunction against alienation of NRI property in India

- Developer Claims under the Consumer Protection Act in India

- NRI property disputes

- Visas to India

- Indian Power of Attorney

- NRI PAN Card

- Overseas Citizenship of India (OCI)

- Inter-Country Adoption

- Divorce proceedings under Indian Law for parties settled abroad