We look at the what and why in AO Code For NRI PAN.

Before we continue, let’s define the term(s) NRI and Foreign Citizen in relevance to this segment.

Firstly, the term NRI is a common or popular term used by most Indians abroad. By way of cultural use, “NRI” is a blanket term used for any Indian living abroad. In the same manner, our segment on AO code clarifies the use of official terminology for AO code applicability in PAN.

The correct definition as per the Government of India; an individual who is of Indian origin and not a citizen of India is classified as a “Foreign Citizen.” As an illustration, you are of Indian origin and hold a British passport for example.

Whereas, you’re officially classed as an NRI (Non Resident Indian) if you’re of Indian origin with Indian citizenship and do not reside in India for more than 182 days in a given financial year.

Now, let’s continue onto the AO code for a Foreign Citizen.

What is the full terminology – AO Code?

AO Code is the short form of “Assessing Officer” (AO).

“Although the Income Tax Department endeavours to provide taxpayers with all necessary services online, on rare occasions you may need to contact your AO.”

INCOME TAX DEPARTMENT GOVERNMENT OF INDIA

What does AO code consist of?

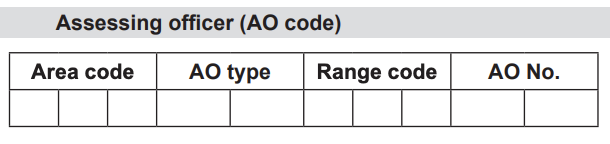

An AO code comprises the following; (Area Code, AO Type, Range Code and AO Number of the Jurisdictional Assessing Officer). It is a regulatory code by the Income Tax Department Government of India. The AO code correlates to a Jurisdictional Assessing Officer acting on behalf of the ITD.GOV.IN.

To demonstrate, below you will find an example of the AO code section on a PAN (49AA) application form. The AO code to be filled is usually located on the top center left area on a PAN 49AA form. Below you will find an example of the AO Code layout as displayed on Form 49AA physical version (hard copy format).

For online PAN Form 49AA application, when applying for PAN the AO code section would be completed online and only when your acknowledgment form is downloaded and printed would you see the below format.

(Ref: ITD.GOV.IN- Forms)

What is the purpose of the AO Code?

By way of an “AO Code” input in PAN an individual can be identified under a particular jurisdiction also known as ward or circle.

The AO Code is an important part of taxation as it determines the jurisdiction of an Individual or Non-Individual. It also details what tax laws are applicable respectively. The right AO Code is essential in relation to tax benefit as the correct taxation rules and regulations would be applicable.

What is an Assessing Officer (AO)?

To clarify, an Assessing Officer is an Officer of the Income Tax Department Government of India. The AO is responsible for ensuring that Income Tax Returns are filed by a taxpayer in his/her jurisdiction correctly. You would not normally need to contact your AO. The ITD promotes online services and only if prompted to do so by the ITD would you need to contact your jurisdictional AO.

What is the administrative function of the AO Code?

The AO Code is determined by your address as well as your status ie; Individual or Non-Individual (companies would come under this category)

Chiefly it has been introduced by the ITD, Government of India for the purpose of effective administration across the country. Specifically, in relation to income tax related services and work. To facilitate the process, a number of wards/circles have been established across the country based on a defined jurisdiction. Each of these wards or circles have a jurisdictional AO (DCIT/ACIT or an ITO). The AO code applies to both Nationals as well as Foreign Citizens. Your AO Code will be specific to your “Area” for example if you are located in Delhi then your AO Code would reflect this.

In effect, as statistics detail, India is set to surpass the population of China as of 2023. The PAN-AO Code most likely will remain an important part of the ITD Government of India administration.

Why do I need an AO Code in my (Foreign Citizen) NRI PAN application?

It is a mandatory requirement by the Income Tax Department Government of India for both Indian Nationals and Foreign Citizens of India.

“It seems complicated and I want to avoid any potential mistakes.” Client

“It requires a little time to understand the requirement and input correct information. The best way to avoid any error is to ensure you understand the requirements and where you feel that you prefer help consider seeking assistance” Whytecroft Ford

Where can I obtain my AO Code from?

You can obtain details from the Income Tax Office or PAN Centre or websites of PAN Service Providers.

What are the Income Tax Department instructions on providing AO Code for (Foreign Citizen) NRI PAN?

When applying for PAN as an NRI, OCI Citizen, Foreign Citizen you will need to provide an AO Code in the AO Code section of the application.

How will I know the correct AO Code as I am an (Foreign Citizen) NRI?

The instructions provided by the Income Tax Department Government of India are to obtain your AO Code from your local office of Income Tax Department in India. However, not everyone is able to do so. This may be for a number of reasons. Such as, you are applying for PAN from abroad, or you are unable to speak with the local ITD whilst in India.

The instructions provide by ITD GOV.IN in such cases for NRI is as follows;

PAN AO Code – International Taxation

- AO Code pertaining to the International Taxation Directorate should be used. OR,

- In the case the applicant is unaware about the correct AO Code, then the applicant can select default international taxation –

AO code of Delhi Regional Computer Center (RCC)

The AO Code is as follows – DLC-C-35-1

I do not know my AO Code. I am a Foreign Citizen (commonly known as an NRI) and applying for PAN. What should I do?

In such instances, follow the instructions by the Income Tax Department Government Of India. Provide the default AO Code.

The AO Code is as follows;

DLC-C-35-1

What if I move my address in India as an NRI to another area?

In such a scenario, as specified by ITD.GOV.IN, you would be required to make a written request to your existing AO for migrating your PAN to the new AO based on your new address.

A circumstance like this may arise from time to time. Consequently, we look at a simulated example; as an NRI you have property in a Northern State of India, from a recent sale you decide to re-invest money into a property in Goa. Further, you decide to place your residential property in Goa on rent which means you start to obtain rental income. You would require to follow due process for AO in relation to your PAN.

Know your AO: You may wish to use the ITD.GOV.IN – Know your AO service online. It would allow you to view the details of the Jurisdictional Assessing Officer (AO) for your particular PAN. You do not have to be registered to use this service. You would already hold a valid PAN and mobile number to be able to use this service. Therefore, it would not be applicable to anyone that does not already have a PAN.

I need help in applying for my PAN from abroad. Can you assist?

Yes we can. We only provide services for Foreign Citizens in applying for their PAN online. You can select a PAN service most suitable to you here.

As well as a PAN I also require Power Of Attorney for India. Can you help me?

Yes we can. You can select one of our Power of Attorney Services here.

Where is your firm based?

We are based in the United Kingdom and provide a range of services for Foreign Citizens – NRI’s across the globe. Our service areas cover a comprehensive list as well as bespoke options. We understand that on occasion “one size” may not fit all.

How can we help you

If you need assistance and are unsure on parts of the application we can assist. Find our range of PAN Application Assistance Service levels by clicking here.

Frequently Asked Questions

Yes it is a mandatory requirement by Income Tax Department Government of India.

AO code pertaining to International Taxation Directorate should be provided. See default code issued by ITD.GOV.IN. If you are unsure, use the default code and apply.

AO is the abbreviation for Assessing Officer

Related Links

- Transfer of property in India

- Indian Property disputes

- Sell property in India

- NRI PAN Card

- PAN Card E-Guide Pack – Service

- Power of Attorney Service

We can also assist with the following NRI Services in London:

- Illegal occupation of property in India

- Family Settlements and partition of NRI Indian property

- Ancestral real estate and inheritance advisory under Indian law

- NRI Property Transfer

- Possession of NRI Property

- Recovery of NRI money under Indian Law

- NRI Succession Certificate in India

- Injunction against alienation of NRI property in India

- Developer Claims under the Consumer Protection Act in India

- NRI property disputes

- Visas to India

- Indian Power of Attorney

- NRI PAN Card

- Overseas Citizenship of India (OCI)

- Inter-Country Adoption

- Divorce proceedings under Indian Law for parties settled abroad